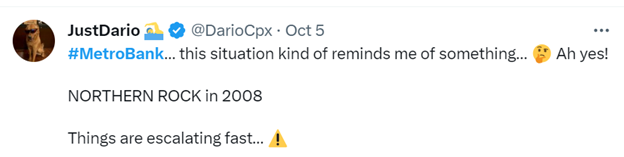

Metro Bank’s share prices have recently plummeted, causing great concern for those who bank with them. After news sources reported that Metro Bank needed to raise up to £600m, the bank’s share prices dropped by a third. The subsequent state of limbo that the bank is now in has caused a lot of chatter on social media. Most of which is not what Metro Bank customers want to hear, with talk of a potential collapse and comparisons being made to Northern Rock.

A recurring theme on social media is account holders pondering whether to take their money and close their Metro Bank accounts. There is further speculation that a mass closing of accounts could occur via online banking. If this were to happen, with some suggestion on social media that it could, the bank could be moments away from a collapse.

Social issues have been thrown into the debate. One user recalled a time this summer when the bank “refused to open a business account for a group of parents because of their belief that it is harmful to give puberty blockers to children, and it ‘conflicts with the ideas’ the bank is pushing.” While this argument may not relate to recent events in everyone’s eyes, it certainly does highlight some disdain and bitterness some have towards the bank at this time.

On the other hand, social media loves clickbait. Less people have suggested this could be the case than those who are fuelling the fire. That is always the case on social media. There are some suggesting that the whole affair has been blown out of proportion. Now it looks like Metro Bank is nearing a deal to rescue it from collapse, with this news bringing ease to the panic of many customers. One thing is for sure: those with links to the bank are concerned and confused and are making their point known.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData