While Rizal Commercial Banking Corporation (RCBC) launched the RCBC Hexagon Club with the intention of boosting the customer experience, it is also helping the bank win market share within the much-prized mass affluent segment and grow its deposits market share. Douglas Blakey reports

Intro: The RCBC Hexagon Club for the mass affluent sector offers personalised interactions, such as exclusive economic webinars online and first opportunities on corporate or investment bonds; simplified banking with a digital first approach and 24×7 digital access and digital onboarding.

Hexagon Club Privilege members or individual accountholders qualify by maintaining balance of PHP100,000 ($1.950) while Prestige members or small and medium enterprises (SMEs) must maintain a PHP500,000 balance to qualify for the programme.

Hexagon Club is a core element of the bank’s major digital transformation programme and investment in building its digital capabilities that support customer-centric solutions. The advent of the Covid pandemic resulted in the bank ramping up its reward strategy by launching an enhanced loyalty offering via the Hexagon Club programme.

RBC noted that as a result of the pandemic, consumer spending decreased, resulting in customer deposits rising.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTapping into the consumer demand for better short term investment opportunities, the bank sought to offer customers better returns on their savings.

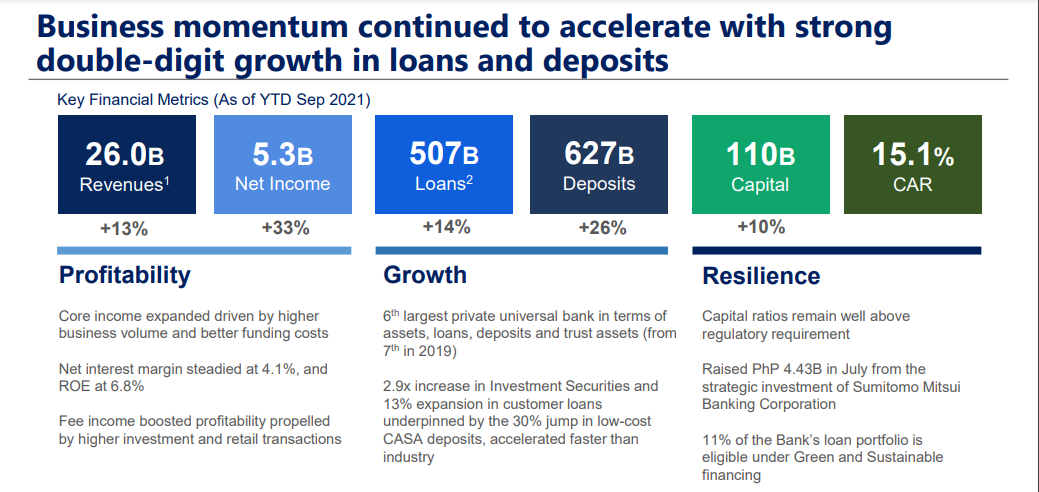

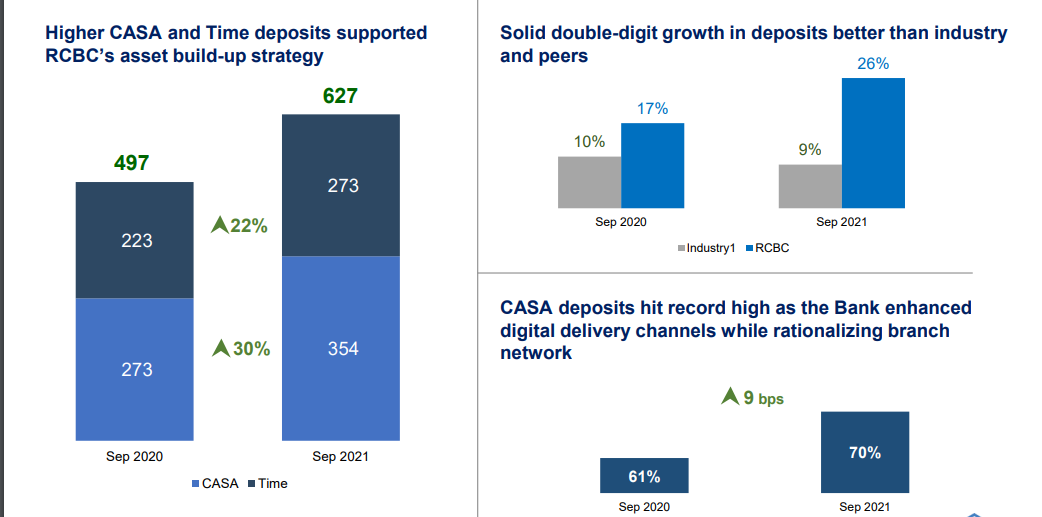

This resulted in a sector beating rise in deposits of 26% year-on-year for the nine months to the end of the third quarter in fiscal 2021.

Specifically, RCBC introduced new options such as a higher add-on rate on short-term time deposits; discounted rates for an auto or a home loan facility to access capital; offered more flexible investment options; and premium discounted rates for foreign exchange (FX) transactions to help family or businesses move money across borders as required.

The bank also waived transaction fees, among many other measures. Additionally, RCBC increased the maximum life insurance option to PHP5m from PHP3m which comes free or with a zero-premium contribution for Hexagon Club members.

Differentiated rewards at a more granular level were also introduced based on Hexagon Club members’ varying deposit levels. These measures all contributed to retail deposits rising and RCBC winning deposits market share.

Hexagon Club highlights

- Increasing its deposit level by PHP40.7bn in 2020-2021;

- Growing its total deposit base to PHP165bn or 48% of total retail business deposits;

- Generating PHP113bn in total current account/savings account (CASA) figures, representing 35% of the Bank’s total retail business in the CASA segment.

- Contributing 42% of deposits generated from new retail customers, and

- Contributing PHP8bn to the consumer loans portfolio (as of April 2021) & adding 19,000 to RCBC’s credit cardholder base.

The RCBC Hexagon Club programme collected the award for Excellence in Mass Affluent Banking at the 2021 RBI Asia Trailblazer Awards. In particular, the judges were impressed with the boost the programme is giving to the bank’s market share for deposits and to the programme’s contribution to the RCBC cross-sell ratio. In particular, Hexagon Club members take up an average of three bank products, compared with a 1:1 ratio for non-members.